Worried about volatile gas prices? Buy these 3 renewable shares instead

[ad_1]

Oil prices have become volatile again, with prices exceeding 20% ​​in the past three months. And there could be more volatility ahead as the economy prepares to rebound and oil producers struggle to activate supply as quickly as needed. The problem is, we don’t know if the oil will go up or down from here.

If you’re worried about oil volatility and want more predictable energy investments, renewable energy stocks can expose you to the energy sector without some of the ups and downs. And three of our Fool.com contributors think SunPower (NASDAQ: SPWR), Equinor (NYSE: EQNR), and Clean energy fuels (NASDAQ: CLNE) are all great ways to invest in renewable energy today.

Image source: Getty Images.

Eliminate volatility with solar power

Travis Hoium (SunPower): If you’re worried about the uncertainty gas prices bring at the pump, rooftop solar power can provide certainty to your energy costs. SunPower offers solar panel leases and loans that provide certainty over electricity prices for homes, businesses and electric vehicles for decades. And with energy storage becoming a more important part of a company’s business, it will provide even more energy services to customers.

Solar installations are often financed through long-term loans or what is called a power purchase contract, where a customer agrees to pay a certain amount for electricity from a solar installation over 20 or 30 years. . This gives certainty as to the costs for homeowners and businesses. This is important in transportation due to the growth in sales of electric vehicles around the world. If customers can now charge their vehicles with electricity generated on site at a predictable cost, this not only reduces volatility, but also saves them money.

SunPower has spent a decade adjusting to the solar energy market, but now it appears to have found an area where it can add long-term value by being a solution provider for installers and building the the technological backbone behind energy storage and the smart home. Management expects revenues to increase 35% in 2021 and EBITDA is expected to triple in 2021 and grow 40% in 2022. If this triggers a trend of growth and improved profitability, it could be a renewable energy stock that beats the market for the next decade. .

High energy transition

Howard Smith (equine): Oil and gas prices have traditionally had significant effects on the inventories of integrated oil companies as well as on downstream refiners. But large energy investors can still be exposed to this sector while reducing the effects of volatile fossil fuel commodity prices. One company that diversifies widely into renewables is the Norway-based global energy company Equinor.

Like all international energy companies, Equinor has been strongly impacted by the decline in energy demand due to the pandemic. It reacted quickly, lowering its dividend by 67% in the first quarter of 2020. But it also continued its investment projects in renewable energies. Last year, the company said it plans to increase its installed renewable energy production capacity ten-fold by 2026 and 30-fold by 2035.

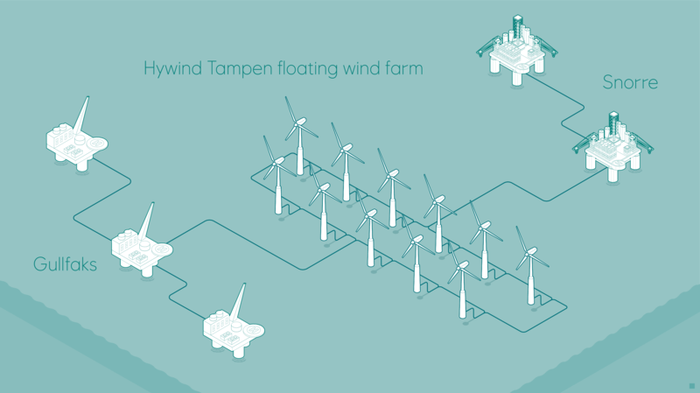

The Hywind Tampen offshore wind farm in the Norwegian North Sea will be the world’s first floating wind farm to supply renewable energy to offshore oil and gas installations. Image source: Equinor.

Equinor also plans to grow its renewable energy portfolio profitably. He has so far invested around $ 3 billion for what he says is an internal rate of return (IRR) of 10%. Its renewable assets currently include solar power plants in South America and, together with its partners, it is building a floating wind farm in the Norwegian North Sea to supply oil and gas platforms. The company wants to become a “big offshore wind company,” she said in a 2020 presentation.

Although it took an important step to reduce the dividend at the start of the pandemic in order to consolidate its balance sheet, investors should feel happy that the company achieved positive net cash flow for the whole of 2020, including 1 , $ 4 billion in the fourth quarter. This is good news for investors looking for future income. Equinor offers investors a way to own great energy with less exposure to fossil fuel prices.

The transition to the future of transportation is already underway

Jason hall (Clean energy fuels): As electrification and hydrogen will play a major role in the future of the movement of people and goods, natural gas is already play an important and growing role. In addition, methane from human-generated waste is a huge problem that is becoming a solution reduce the carbon footprint of transport. And no other company is better positioned to take advantage of this trend than clean energy fuels.

Over the past decade, Clean Energy has deployed hundreds of natural gas refueling stations, intended not for personal automobiles, but for large commercial fleets, especially heavy-duty vehicles like garbage trucks, semi-trailers, concrete buses and trucks. And it paid off, with strong growth in operating and free cash flow, which went from negative to solid – and increasingly – positive:

CLNE Cash from Operations (TTM) data by YCharts

Today, the majority of that cash flow still comes from natural gas derived from fossil fuels, but the company has shifted much of its supply to renewable natural gas, which it sells under its “Redeem†brand. Redeem represents approximately 40% of the company’s transportation fuel volumes and is growing very rapidly.

The bottom line is that while electric trucks and hydrogen will be part of the mix in the future, so will renewable natural gas, and it is the only one that fleets can buy on and integrate into their operations. now and count to meet all their needs. . This is a great reason to consider clean energy fuels for your wallet.

The future of energy is not oil

These three companies are building the future of energy with renewable products. And they’re both less volatile and less expensive than oil, which is a big reason we’re excited about these stocks for the long haul.

This article represents the opinion of the writer, who may disagree with the “official†recommendation position of a premium Motley Fool consulting service. We are motley! Challenging an investment thesis – even one of our own – helps us all to think critically about investing and make decisions that help us become smarter, happier, and richer.

[ad_2]