How a Bank Resurrected SolarReserve’s Redstone CSP with ACWA Power

[ad_1]

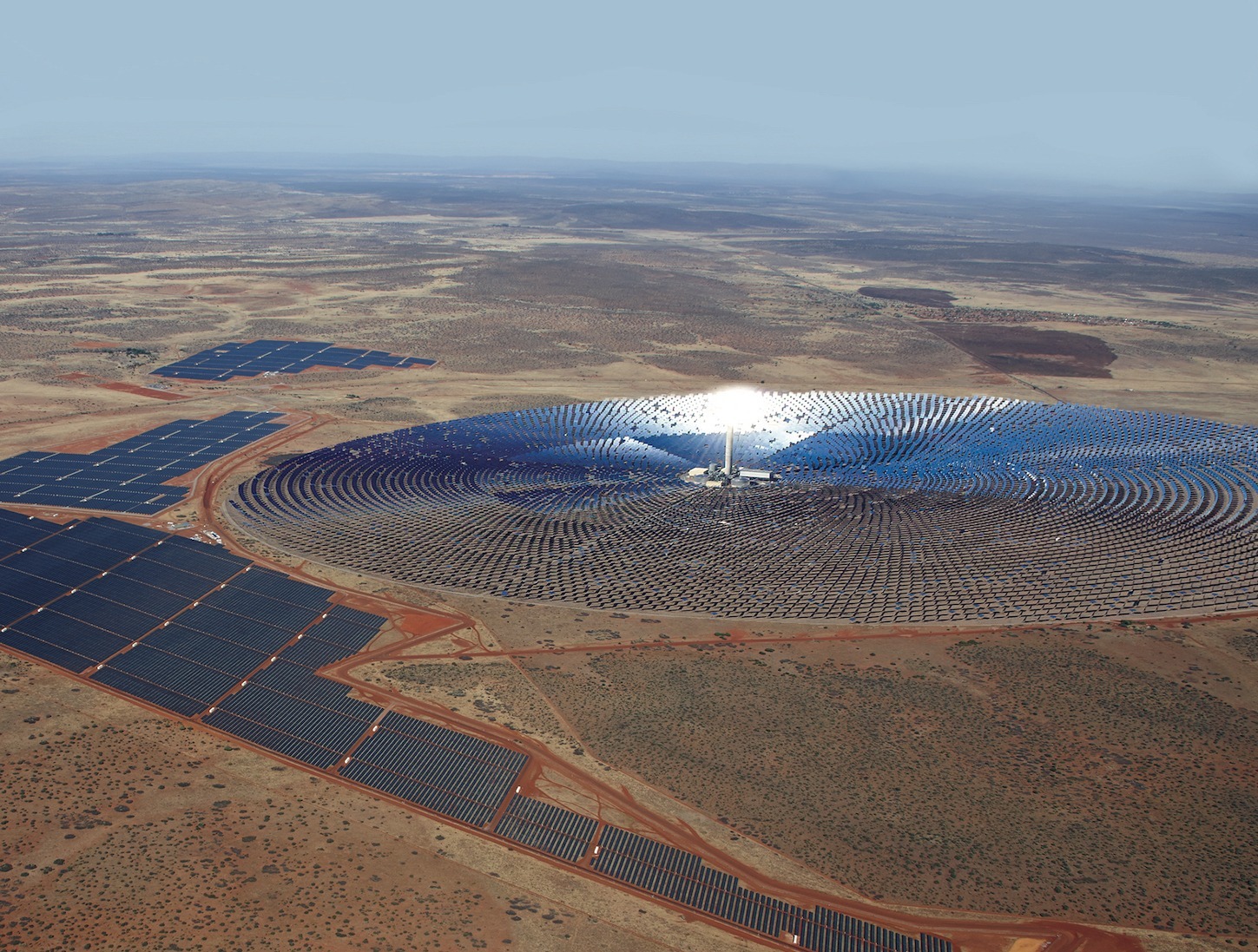

SolarReserve / ACWA Power Redstone 100 MW Power Tower CSP IMAGE @ SolarReserve

SolarPACES interviewed Bernard Geldenhuys, lead actor in the Energy and Infrastructure team at Investec Bank, a lender with 8,300 employees closely involved in the 100 MW Redstone solar tower since 2018, when his deferred PPA was signed with Eskom, as the first commercial bank to back the transaction, providing senior debt worth R750 million and currency and interest rate hedging. Redstone is now funded at R11.5 billion (approximately US $ 837 million) and is finally poised to innovate, with completion expected by the end of 2023. Eskom had put it on hold in 2016 as well as other renewable PPAs. With advantages of scale and continued reductions in CSP components, Investec says Redstone will have the ‘lowest tariff’ of concentrated solar power plants (CSPs) in South Africa, but has not disclosed the price. of the 20-year PPA with Eskom.

Question: How did you get the Redstone Tower CSP back on track?

A: Redstone is important to the South African economy. Eskom urgently needs around 6,000 MW of base power over the next five years. This problem is partly addressed by the 2,000 MW RMIPPP program. ACWA Power Redstone, with its 33-month construction period, 12-hour thermal energy storage, and 35-year useful life, is capable of delivering fully distributable base electricity to the grid to meet these requirements. This is the first REIPPP (Renewable Energy Independent Power Producer Procurement) project to provide ancillary services such as grid stabilization to Eskom at no additional cost.

Question: Do you form financial consortia with other lenders to build renewable energies?

A: Yes, Investec has been the arranger of several renewable energy projects including the 94 MW Aurora WindPower project, the 50 MW ACWA Power Bokpoort CSP project, the 100 MW Kathu Solar Park project and the 75 MW Sishen Solar project. MW.

Question: Redstone was originally developed by SolarReserve. Has ACWA Power shifted to new component suppliers and if so, has that helped make it more profitable?

A: After the release of SolarReserve, the main equipment suppliers were replaced by Brightsource Energy for the heliostats and their control systems, and CMI for the central receiver. To our knowledge, this change did not require a permit change for the project. The PPA amendment was not dependent on the technology provider. The backgrounds of ACWA Power, Brightsource and CMI contributed to the bankability of the project.

(CMI was also selected for the receiver on ACWA Power’s DEWA project.)

Question: Are these delays in accepting renewable PPAs a problem for the future?

A: Although the purchase of BW4 has been significantly delayed, I think we are on the right track. In March 2021, the DMRE announced the opening of bid window 5 of the REIPPP program which will supply 2,600 MW of renewable energy to IPPs. The announcement of Offer Window 6 is expected to take place in the year 2021. This aggressive rollout is aligned with IRP 2019 whereby 6,000 MW of new solar PV capacity and 14,400 MW of new wind capacity are to be commissioned by 2030. Last month, the DMRE published a notice in the government gazette of its intention to increase the threshold for integrated generation from 1 MW to 10 MW. This will strengthen the deployment of renewable energies (mainly solar energy on rooftops) in the commercial and industrial space. Additionally, it is interesting to note that a large portion of the projects that have received preferred bidder status for the RMIPPP program have a renewable element.

Question: What regulations drive South African renewable energies?

A: The South African government is a signatory to the COP 21 agreement and intends to make the country carbon neutral by 2050. SA will develop its own renewable energy projects for at least the next 10 years, due to the economic benefits it provides in terms of infrastructure construction, jobs, etc. DMRE must commit to its ambitions as part of IRP 2019 – which seems to be the case.

Question: Considering your breakthrough in Redstone and Bokpoort’s excellent performance, are you working with ACWA Power on a new CSP for South Africa?

A: Not currently. There is no allocation for the CSP in the current Supply Window 5 of the Independent Power Producer Supply Program (“REIPPPâ€) of the Ministry of Mineral Resources and Energy (DMRE).

The CSP was also not a viable option for the recent Independent Power Producers Market for Risk Mitigation (“RMIPPPâ€) given the short construction period due to the longer lead times required for a CSP plant.

Question: Didn’t one of the first South African CSP plants try steam for thermal energy storage?

A: Only a tower project; Khi. All CSPs in South Africa have molten salt storage systems, as does Redstone. Khi was the pilot plant of Abengoa at the scale of 50 MW, following their PS10 and PS20 projects in Spain, before a first large-scale CSP tower of 100 to 150 MW. There are some steam related issues that affect the overall efficiency of the plant. The thermodynamics of a continuous and fluid steam generation process where steam is generated in the tower is very complex and faces many problems. It is extremely difficult to maintain the overall quality of the steam from the receiver, where it is produced, to the steam storage system and to the steam turbine. Steam accumulators are large, expensive and have at best only a few hours of storage capacity. Much more heat can be stored in molten salt, and for longer periods.

Question: ACWA Power’s other CSP in South Africa, the 50 MW Bokpoort trough plant you funded, seems to be working well. You led a R5 billion refinancing round – roughly $ 366 million in USD. Does it pay back loans on time?

A: Yes, Bokpoort is operating as expected.

Question: While there have been a lot of PV companies building large solar farms in the United States, only one (First Solar) ended up getting almost all of the big solar farm contracts: is ACWA becoming the ‘CSP equivalent?

A: I think so. ACWA Power currently has approximately 1,510 MW of CSP projects in its portfolio, with Redstone bringing this figure to 1,610 MW. ACWA Power seems to be increasingly the only developer with new projects: Morocco, Dubai, and now Redstone is back in South Africa.

Q: Are you involved in the Biden MoU with Botswana and Namibia for 5 GW of solar power?

A: No, we are not yet involved. We’ve only read about it, but we’re not sure exactly what’s in the pipeline and who will be the taker of so much power. The only reasonable chance of doing this is that the project intends to produce green hydrogen and export it as fuel.

Q: Haven’t Botswana and Namibia done CSP feasibility studies? Have they decided to go ahead?

A: No. All Namibian and Botswana CSP projects have been put on hold and, in both countries, solar PV and battery storage in selected projects is being planned. I am not aware that a single CSP factory is still under development. Both countries consume relatively small amounts of electricity, and the construction of large 150 MW CSP plants would account for around 25% of total electricity demand. Since both countries are sparsely populated and cover a large area, it makes more sense to build small solar PV plants as well as storage closer to consumers.

Q: Are there no regional electricity markets?

A: Currently, electricity can only be exchanged bilaterally between the different electric utilities owned by the Southern African state. There is no regional electricity market on which the 5,000 MW can be sold. It could take at least another 5-10 years to settle the policy and achieve a regional market.

Q: As an independent financial advisor in energy projects there: have you advised on desalination or hydrogen production where CSP and CST could intervene?

A: A 5,000 MW solar project jointly developed by these two countries with hydrogen / ammonia production near a Namibian port with an expert anchoring client could be the solution to achieve several objectives; desalinated water, cheap electricity for both countries, export earnings for Namibia / Botswana. Similar projects are currently planned in Australia. If large scale production of green hydrogen / ammonia is continued, then water desalination is required for the electrolysis of water to obtain hydrogen. Since water consumption for hydrogen production consumes most of the water, the additional cost for desalinated water is relatively low. Numerous studies have been carried out where waste heat from thermal power plants is used to facilitate desalination. Ultimately, the cost of electricity will determine which technology to use. Electricity costs for large-scale solar PV plants are currently offered at prices well below USD 0.03 / kWh and in some cases below USD 0.02 / kWh, where the lowest cost of electricity of CSP power plants is around 0.07 USD / kWh in the United Arab Emirates.

Q: How fast do you envision commercializing hybrid thermal storage – or SCO2 CSP? Or do you see other CSPs in the area using current technology?

A: Not likely. Maybe in Morocco there could be more projects. As you know, there is the intention to hybridize the CSP with solar PV technology in the latest projects in Morocco; Midelt. We will have to see what costs they come back.

There are also technology projects to replace the steam-based Rankine cycle with a supercritical CO2-based Brayton cycle to increase overall plant efficiency and reduce plant complexity. But all of these attempts will take at least 10 more years to mature the technologies. The most important cost cutting factor has been the scaling up of production capacity that we have seen for solar PV. CSP plants will always remain discrete, unique projects, and although designs may be standardized, they remain complex to build and operate.

Q: Do you have any ideas on the future of energy in the world?

A: I see no future in coal-based investments. Limited future for the next 20 years in gas-fired power plants – only to help build a bridge to a zero carbon future. Solar photovoltaic and wind, onshore and offshore. More investment in storage technologies, especially 8 hour long term storage. In addition, more investments in energy efficiency and to make hydrogen an important future energy carrier to decarbonize many industries where heating and cooling dominate. So far, infrastructure deployment has been too slow to meet the 1.5 ° C target, as it is generally not recognized that electricity is only a small part of the total energy picture.

[ad_2]