Fintechs hope PPP performance will lead to expanded role with SBA

[ad_1]

Many fintechs have struggled to gain traction in the paycheck protection program.

Most were excluded from the first round of the $ 669 billion emergency loan program, instead acting as agents for lenders who have been approved to participate.

Those who are now allowed to participate are trying to make up for lost time, hoping that a solid finish will strengthen their case for inclusion in traditional programs run by the Small Business Administration.

The delay represented a “missed opportunity” for fintech, said Eric Corrigan, general manager of Commerce Street Capital’s financial institutions group in Dallas.

“The fintechs really wanted to help,” Corrigan added. “They should have been the solution for smaller, less financially sophisticated borrowers from day one.”

Early exclusion still leaves a sting for some executives.

The Funding Circle team spent long days and nights processing loans for other lenders during the first phase. Since becoming a direct participant on May 1, the London-based fintech has caught up by processing thousands of applications.

“We were on the phone,” said Ryan Metcalf, public policy manager for Funding Circle. “It left us where we are today, which helps the smallest of small businesses. … I would definitely say they are on the small side of the spectrum.

Other fintechs have found meaningful participation in the elusive program.

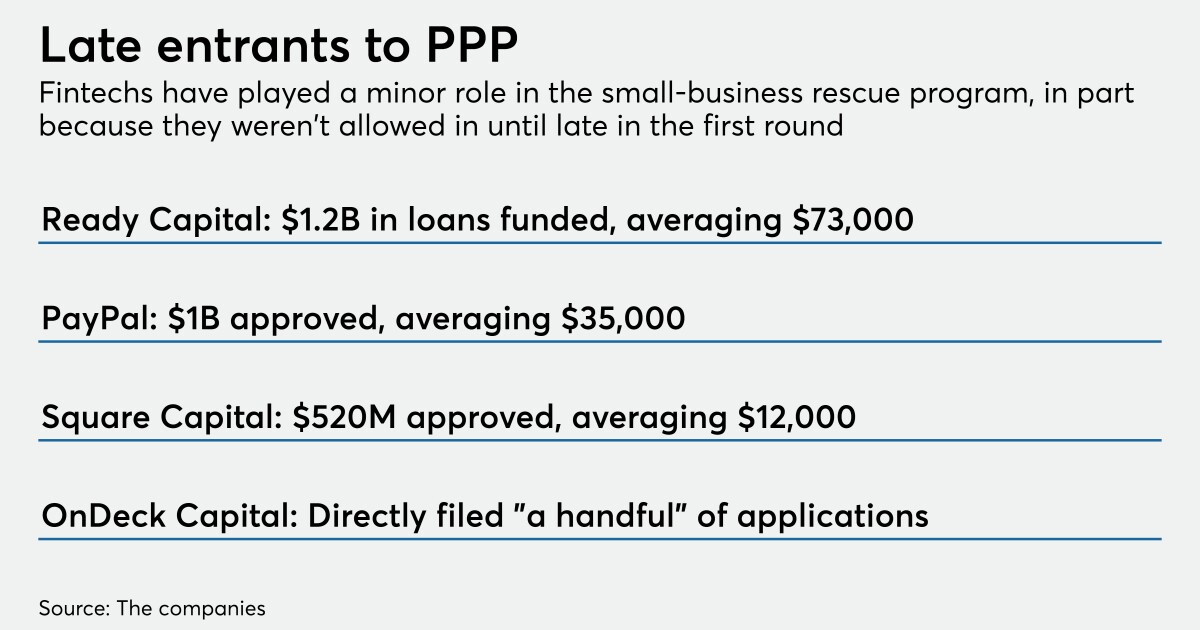

OnDeck Capital’s initial involvement was “de minimus,” with limited involvement in helping approved lenders, Noah Breslow, chief executive officer of the New York-based lender, said on an April 30 conference call. The company was approved as a direct participant one day after the initial funding was exhausted.

OnDeck’s direct involvement in the current iteration of the program had been limited to “a handful” of applications because it did not have access to the Federal Reserve’s paycheck protection liquidity facility, a. said Breslow. (The Fed opened the facility to all PPP lenders on May 1.)

Despite a bumpy integration, many fintech executives are optimistic about their ability to generate significant volume from now until the current allocation dries up.

“We don’t see the mad rush or the panic that the money is going to run out,” said Rohit Arora, CEO of Biz2Credit, which has been approved as a direct lender. “It will help [phase two] last longer than people expected.

Fintechs also highlight their inclusion as a factor in the substantial drop in the average loan size of the program.

The average paycheck protection loan in the second phase was $ 79,000 on May 1, about a third of the size of the average loan size for the first round, which ran from April 3 to 16.

When Funding Circle first started lending directly, less than two-thirds of its requests were for less than $ 50,000. This share rose to almost 80%. Applicants employ an average of 17 people, Metcalf said.

Ready Capital in New York reported an average loan of $ 73,000. The average at PayPal was $ 35,000, while the average at Square Capital is $ 12,000.

Biz2Credit has received several thousand requests, mostly from small borrowers, Arora said.

“We believe we have been instrumental in helping to ensure that these funds reach the smallest businesses that create vibrancy in our communities,” said Jackie Reses, director of Square Capital. “This relatively small amount makes a huge difference for real small businesses.”

Square has submitted 54,000 claims to the SBA for more than $ 850 million in loans.

The program, which is run by the SBA and the Treasury Department, was created too quickly to get money for employees of small businesses. Under the coronavirus stimulus package, loan proceeds spent on payroll and benefits, as well as some basic operating expenses, will be canceled.

In its race to implement paycheck protection, the SBA has not been able to write the necessary guidelines for fintechs to start lending before the end of the first phase.

An SBA spokeswoman said she was unable to respond to a request for comment.

The delayed entry may have spared fintechs a problem plaguing banks.

Phase one larger loans have become a political headache. Media critics and officials from both political parties looked at loans approved for large publicly traded companies and well-funded private schools, while denouncing the lack of access for small businesses.

Fintechs also hope their late-stage role will help them advocate to become a participant in traditional SBA initiatives such as the flagship 7 (a) Guarantee program. No fintech is currently approved to serve as a 7 (a) lender.

While 7 (a) loans are drastically on the decline as lenders focus on P3s, small businesses will need these loans to restructure, buy new inventory, and seek growth opportunities when the crisis-induced crisis. coronavirus will end, Metcalf said, adding that Funding Circle is seeking entry. the regular program 7 (a).

The 7 (a) program “will be the primary conduit for small business capital for the foreseeable future,” Metcalf said.

Funding Circle also wants the SBA to allow it to lend nationally, which the agency was unwilling to consider because most fintechs don’t have a national regulator.

“We don’t want to be limited to making loans in one state,” Metcalf said. “We should be able to operate in the 50s.”

The recent approval by the Federal Deposit Insurance Corp. an industrial loan company charter for Square would likely facilitate the company’s inclusion in 7 (a) – a move Reses has not ruled out.

“In addition to expanding our capabilities to offer small business loans, we look forward to bringing other key banking tools to underserved small businesses,” Reses said.

Although Biz2Credit did not disclose any plans for admission to 7 (a), Arora said that over time, smaller businesses may benefit more from increased access to general working capital than from loans to companies. special purposes intended for employee compensation.

Arora said he wouldn’t be surprised if small business advocates started pushing for changes to make PPP loans more like regular 7 (a) loans, with longer maturities and the possibility to spend the proceeds to replenish inventory and for other non-wage purposes.

“Making it look more like 7 (a) might make the program more successful,” Arora said.

Paul Davis contributed to this report.

[ad_2]