Daily update: September 24, 2021

[ad_1]

Start each business day with our analyzes of the most pressing developments affecting the markets today, as well as a curated selection of our most recent and important information on the global economy.

Market players are investing in offshore wind farms to achieve the energy transition from the production of fossil fuels to renewable energy sources.

“Offshore wind will play a decisive role in the objective of the EU and the United States to achieve carbon neutrality by 2050. Today, it represents only 3% of the European electricity mix and remains marginal elsewhere. We expect global installed capacity to exceed 180 GW by 2030 (6 times more than today), â€S&P Global Ratings said in a recent report. “With 25 GW of installed capacity at the end of 2020, Europe represented 72% of the global offshore wind market, S&P Global Platts Analytics expecting the region to represent 60% by 2030… Offshore wind is still lacking currently competitive in the United States, but the economy is improving.

Global investments in offshore wind projects are accelerating, led by Europe. The region aims to install more than 100 gigawatts of offshore wind capacity by 2030, up from 25 gigawatts today, and may need to install at least 400 gigawatts of additional capacity in order to reach net zero by 2050 , according to S&P Global Ratings. French cable operator Nexans told S&P Global Platts it expects the offshore wind cable market to grow 250% by 2030, and is already planning projects from Norway to North Carolina.

As a historical pioneer in offshore wind, the UK has consolidated its position as a global technology leader with new offshore wind projects and investments, most recently in Scottish waters.

“We have the best resource and possibly one of the best geographies for offshore wind in the world,†Barnaby Wharton, director of future power systems for the RenewableUK business group, told S&P Global Market Intelligence in an interview. “We are very lucky to have the North Sea, which is shallow and where the winds are very strong.”

The Biden administration aims to build 30 gigawatts of offshore wind capacity by 2030, and the pipeline for offshore wind generation in the United States quickly expanded to 29 gigawatts in August, according to S&P Global Ratings. As potential market shifts in capacity in transportation markets and huge investor interest create more opportunities for offshore wind development in the United States, government agencies are examining new offshore projects in California , New Jersey, Rhode Island and Virginia. The first large offshore wind farm in the United States, located off Martha’s Vineyard in Massachusetts, was approved by the Biden administration in May.

As climate risk intensifies, offshore wind is an attractive investment proposition for decarbonization because “the wind is blowing quite constantly, and … building a project at Dominion Energy, the Energy Evolution podcast from S&P Global Market Intelligence. “You are getting closer to renewable energy 24/7.”

Today it’s Friday, September 24, 2021, and here is today’s essential intelligence.

Uncertainty in the global economy

Europe Q4 2021 economic outlook: a faster take-off than expected

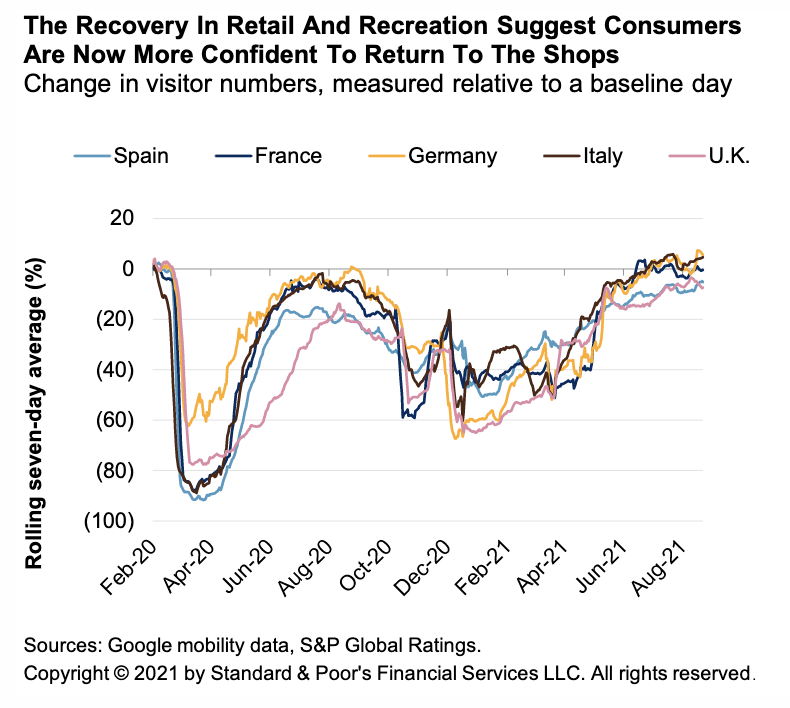

The rebound in the European economy since the lifting of restrictions in March / April has been surprisingly strong, both in terms of GDP and employment.

—Read the full report of S&P Global Ratings

UK Economic Outlook Q4 2021: The recovery is still on track

The UK’s economic recovery came to a halt in July, largely due to one-off factors, such as ‘pingemia’, when the National Health Service’s tracking app informed users that they had been in. close contact with someone who tested positive for COVID-19 and who needed isolation.

—Read the full report of S&P Global Ratings

Biden faces tough sales in Glasgow if Congress blocks passage of reconciliation bill

Failure by the US Congress to pass a budget reconciliation package laden with climate policies and clean energy investments would not only be a blow to President Joe Biden, but would significantly hurt the prospects of securing action plans more aggressive climate change around the world, the head of the Environmental Defense Fund said on Sept. 22.

—Read the full article by S&P Global Platts

The credit cycle

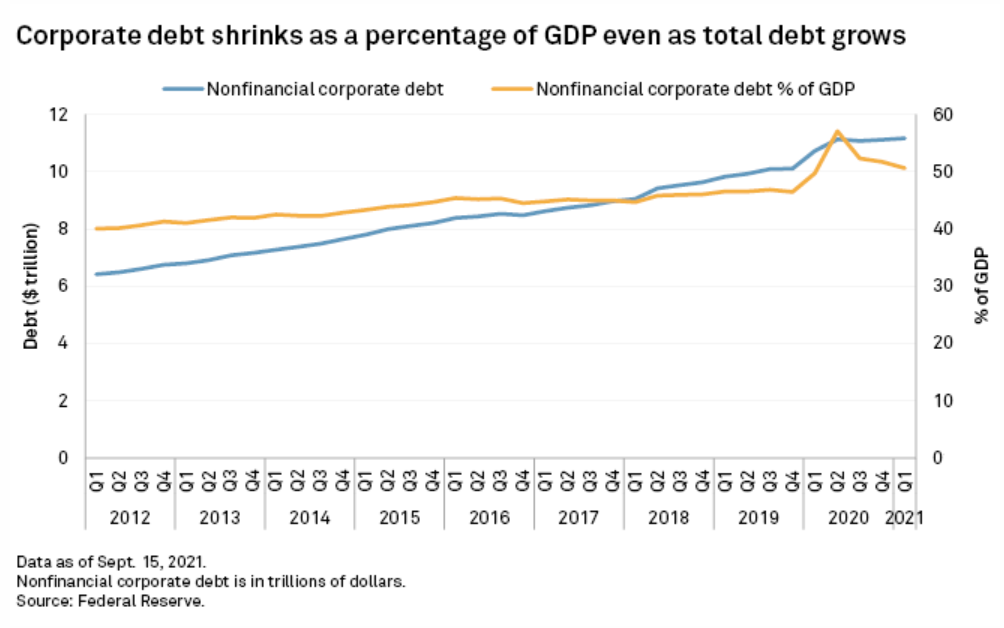

Weaker US economy threatens rising corporate debt

Slowing economic growth in the United States and an expected increase in borrowing costs could make American businesses vulnerable after interfering with debt during the pandemic.

—Read the full article by S&P Global Market Intelligence

Market dynamics

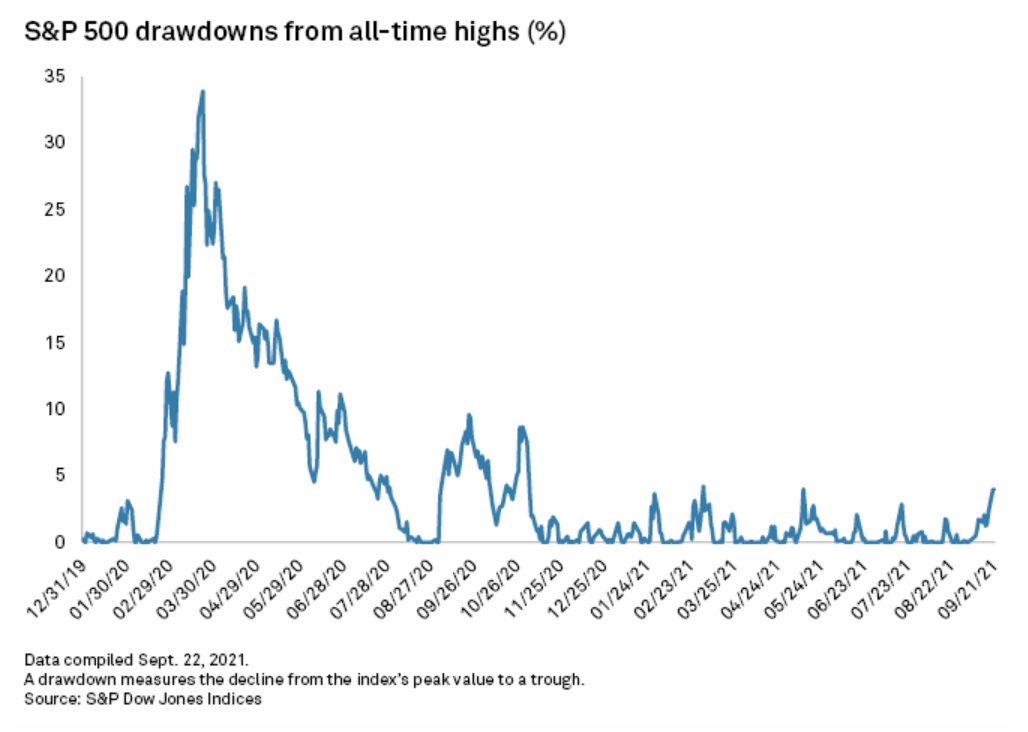

Bear market unlikely, but a stumble in stocks could lead to a larger fall

Investors ignored this week’s fall in stocks as a slowing of the historic rally in the stock markets. But the cracks in the race widened in September, and market analysts see growing potential for a significant correction.

—Read the full article by S&P Global Market Intelligence

The importance of order

We all know that stock returns vary widely over time. For example, the performance of the S&P 500® between 1981 and 2020 ranged from -37% (2008) to + 38% (1995). The annual compound market return for this period was 11.5%.

—Read the full article by S&P Dow Jones Indices

Global Diversification Trend In India – Time To Realize It?

The merit of international diversification seems to have been proven in recent times in the context of the Indian market. Over the past year, interest has grown in adding global exposures to local investment portfolios.

—Read the full article by S&P Dow Jones Indices

Technology and Media

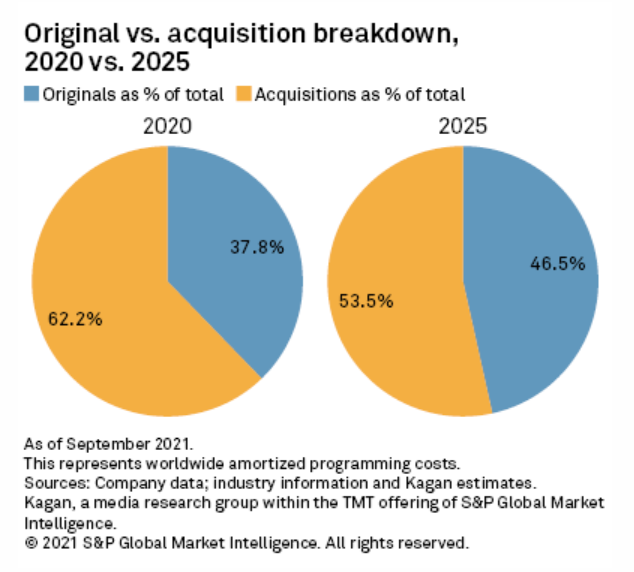

Netflix’s amortized content spending estimated at $ 13.6 billion in 2021

After a difficult year for productions and increasing competition in the streaming space it has necessitated an increase in the program budget for Netflix Inc. in the years to come. For 2021, we forecast the company could write off around $ 13.60 billion in total costs, including $ 5.21 billion for the originals.

—Read the full article by S&P Global Market Intelligence

Live TV still dominates most TV shows in Asia

The Kagan 2021 Asia Consumer Insights survey found that almost all adult internet users in China watch videos online, using an average of five OTT video services. The same goes for India. Nine in ten adult internet users in South Korea also say they watch videos online.

—Read the full article by S&P Global Market Intelligence

Listen: Take Notes – Structured Finance vs. Structured Finance. Cyber ​​risk

This episode explains how a securitization might be vulnerable to a cyber attack, the structural features available to mitigate and manage the cyber attack, how cyber risk is factored into rating analysis, and how ratings could be affected.

—Listen and subscribe to Take Notes, a podcast of S&P Global Ratings

ESG in the time of COVID-19

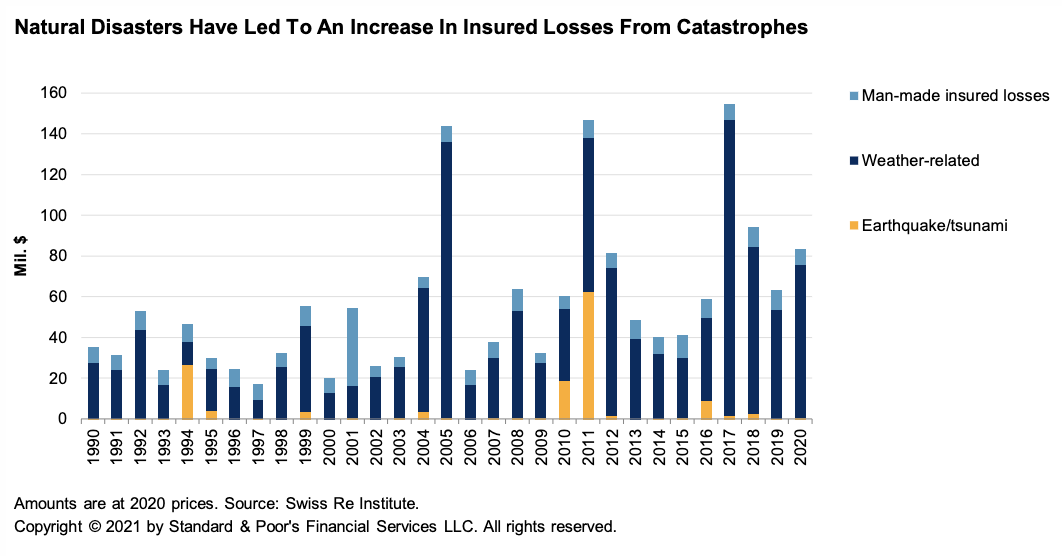

Global reinsurers grapple with the risks of climate change

Reinsurers have stepped up their efforts to integrate climate change into their decision-making process, including risk management, exposure management and pricing. However, this is still nascent in the industry, and many companies find it difficult to implement climate change considerations in a robust manner.

—Read the full report of S&P Global Ratings

Green bond premium justified by strong secondary market performance, flexibility

The higher price that investors pay for green bonds in the primary market is justified by the good performance and flexibility of instruments in the secondary market, according to industry players and new research.

—Read the full article by S&P Global Market Intelligence

U.S. solar trade feud erupts at critical time for Democrats’ climate agenda

The latest trade policy row in the U.S. solar industry comes at a critical time for President Joe Biden, who hopes to make the country a leading manufacturer of green energy technology while ensuring efforts to limit change climate are not hampered by soaring prices or equipment shortages.

—Read the full article by S&P Global Market Intelligence

Net zero commitments, financial vehicles evolve amid decarbonization trend

Companies’ commitments to net carbon emissions can be difficult to decipher and measure, which is an issue energy companies must address as the market for linking commitments to finance tools grows, people said. investment and industry experts.

—Read the full article by S&P Global Market Intelligence

Impact of electric vehicles: the rise of electric vehicles reinforces the need for network integration

The millions of new grid-connected cars, vans, trucks and other electric vehicles that hit the road each year won’t get far without sufficient charge for their increasingly powerful lithium-ion batteries.

—Read the full article by S&P Global Market Intelligence

The future of energy and raw materials

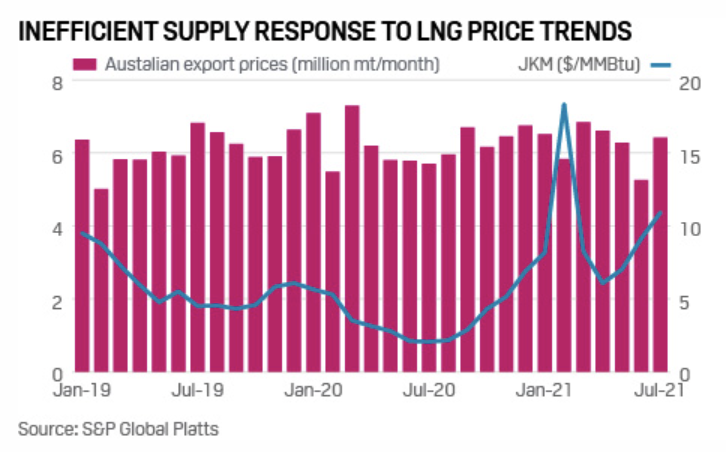

Spot and Term, Australian supply and Asian demand: indelible links in the LNG market

As the LNG market matures, the spot price of the raw material has become the price driver for all types of contracts, including long-term contracts. This is particularly relevant for exporting countries like Australia which are undergoing changes in their downstream gas market development and pricing policies.

—Read the full article by S&P Global Platts

China’s overseas coal hub sends strong signal, but experts await details

China’s pledge to stop building overseas coal-fired power plants is another blow to an increasingly difficult sector, but the damage it inflicts will depend on several unknowns surrounding the implementation of the commitment.

—Read the full article by S&P Global Market Intelligence

Feature: Soybean meal premiums rise to record in Latin America

Base levels of FOB soybean meal in South America have reached record highs due to strong Indian demand and the effects of Hurricane Ida on export facilities on the US Gulf Coast, according to sources.

—Read the full article by S&P Global Market Intelligence

Listen: How are rising prices and new green regulations affecting the demand for heating oil?

As summer finally draws to a close and the mornings turn chilly, we expect the demand for heating oil to increase in Europe as no boom has been reported yet. In addition, new environmental regulations will be applied in many European countries in 2022, which could lead to changes in purchasing habits.

—Listen and subscribe to Oil Markets, a podcast of S&P Global Platts

Written and compiled by Molly Mintz.

[ad_2]