Finance Debt

-

Coronavirus pandemic threatens Pennsylvania’s already vulnerable dairy farms

[ad_1] “Maybe that’s what hurts the most – it wasn’t anyone’s fault… Now it’s like, ‘Huh. We really can’t win. – Donny Bartch, a ... -

How does my business qualify for a green loan? | Alston and Bird

Put the E in ESG. Continuing our dive into environmental, social and governance (ESG) finance, our financial group examines the what, why and how of green lending principles.

- What is a green loan?

- The 4 basic components

- Recent green loans in UK and Europe

Part 1 of our ESG series introduced ESG, examined its impact on structured finance markets, and examined the implications of the COVID-19 pandemic on ESG.What are green loans?

Following a profusion of sustainable finance and development initiatives, both internationally and nationally in 2018, as evidence of changing investor preferences and increased recognition that investments in well-governed entities that create a positive social and environmental impact are increasingly important, the Loan Market Association (LMA), Asia Pacific Loan Market Association and Loan Syndications and Trading Association (LSTA) have launched the ‘Principles of green loan(GLP), which were designed to provide environmental, social and governance (ESG) criteria for credit products.

Since the launch of BPL, in all structured finance markets, an increasing number of “green” loans have emerged. The BPL defines green loans as “any type of lending instrument made available exclusively to finance or refinance, in whole or in part, new and / or existing eligible green projects. … Green loans must be aligned with the four essential components of GLP ”.

In other words, Green Day Online are loans whose proceeds are used specifically for environmentally friendly or sustainable purposes – for example, building solar or wind farms or investing in new green technologies. The BPL also places a very strong expectation that green loans will require continuous reporting and monitoring to ensure that the loans are being used for their intended purposes throughout the life of the loan. It is important to note that a distinction should be made between green loans and sustainability loans (and the LMA / LSTA sustainability lending principles), which we will discuss in our next article. The classification of loans linked to sustainability does not depend on how the product is used – the key characteristic is rather that the pricing is linked to the performance of the borrower against predetermined sustainability criteria. How businesses can attract cash for green loans has become a task that will become increasingly important in a post-COVID-19 world where cash scarcity will determine the survival of some businesses.

As a growing number of lenders seek to offer better loan terms to borrowers who are able to show they are reducing their environmental impact, green loans are growing rapidly. And it looks like the coronavirus pandemic hasn’t stopped the surge in green lending.

Why should my business take out a green loan?

There are a number of advantages for borrowers and lenders to take out green loans. The BPL suggests the following non-exhaustive list:

- Positive impact on the environment, climate change mitigation and adaptation.

- Positive impact on reputation and credibility.

- Build stronger, value-based relationships with stakeholders.

- Access new markets, offer greater resilience to market disruptions caused by climate change and reduce risk in portfolios.

- Access a larger and more diverse pool of investors, especially those looking for ESG-focused investments.

- Achieve regulatory and political objectives and commitments.

- Increase the ability to attract and retain staff who view contributions to sustainable development as an important part of their personal and professional life.

How does my business qualify? The 4 basic components

In order to qualify for a green loan, your business will need to comply with the “4 basic components”.

1. Use of the product

The fundamental determinant of a green loan is the use of the loan proceeds for green projects (and other related and support expenses, including R&D), which should be appropriately described in financial documents and, where applicable, in marketing materials. Your green projects should provide clear environmental benefits, which will be assessed and, if possible, quantified, measured and reported.

2. Project evaluation and selection process

You will need to clearly communicate to your lenders:

- Your company’s environmental and sustainable development goals.

- How your business determines how its projects fit into the eligible categories.

- The associated eligibility criteria, including, where applicable, exclusion criteria or any other process applied to identify and manage potentially significant environmental risks associated with the proposed projects.

3. Product management

The proceeds of your green loan will need to be credited to a dedicated account or otherwise appropriately tracked to maintain transparency and promote the integrity of your green loan. If your green loan takes the form of one or more tranches of a loan facility, each green tranche should be clearly designated, with the proceeds of the green tranche credited to a separate account or appropriately tracked.

4. Reports

You will have to make and keep up-to-date and easily available information on the use of the product to be renewed annually until it is fully used, and if necessary thereafter in the event of significant developments. According to the BPL, “this should include a list of green projects to which the green loan proceeds have been allocated and a brief description of the projects and amounts allocated and their expected impact”. When confidentiality is an issue, information can only be provided to institutions participating in the loan. GLP recommends the use of qualitative performance indicators and, where possible, quantitative performance measures (e.g. energy capacity, power generation, reduced / avoided greenhouse gas emissions) and disclosure of the Key underlying methodology or assumptions used in the quantitative determination.

Avoid greenwashing!

Greenwashing, in the context of green loans, occurs when a borrower or project is supposed to have green credentials, but those credentials are bogus, over-excited, or misleading. Of course, this practice is strongly discouraged by all market players. Many lenders have sought to prevent borrowers from taking advantage of favorable terms on their green loans by introducing quantitative environmental measures. For example, ING requires that any green loan meets at least three of its five ESG objectives.

Charges of greenwashing can lead to litigation, undermine investor confidence and call into question the integrity of green loans. The GLP and the four building blocks are therefore written to provide a clear framework of the processes to be followed to maintain the integrity of green loans.

Recent developments in the UK and Europe

Bank of Scotland £ 30million green loan for Glasgow properties

In mid-May, Dunaskin Properties secured £ 30million in financing from the Bank of Scotland against 10 of its downtown properties, including Baltic Chambers, Central Chambers and Ingram House.

The financing package was set up as part of the Bank of Scotland’s Green Lending Initiative and consisted of a term loan and revolving credit facility which gave Dunaskin the flexibility to trade assets and fund capital expenditures across the portfolio.

The green loan was part of the refinancing discussions and the broader plans for a clear sustainability strategy for Dunaskin. The terms of the deal include green commitments requiring the company to spend £ 1.2million on improving the sustainability of its buildings and meeting a number of EPC improvement targets.

IPUT Real Estate’s € 300 million green loan with Wells Fargo

At the end of May, the Irish real estate company IPUT Real Estate signed a revolving credit line (RCF) of 300 million euros with Wells Fargo, increased by an existing RCF of 50 million euros. This made RCF Augmented the largest green finance facility in the Irish property market. RCF’s € 200 million green component will be used to finance green projects that meet several criteria based on GLP and tested by several renewable and energy efficient metrics.

Van Oord’s green loan agreements with Rabobank and BNP Paribas

In June, Van Oord, a dredging specialist based in the Netherlands, signed its first green loans with Rabobank and BNP Paribas. The green loans were based on Van Oord’s SEA sustainability program and will fund three new trailing suction hopper dredgers that will each get a green passport and clean ship rating. Van Oord’s SEA program is based on BPL, and one of its advantages is that additional green loans can be added in the future.

The ESG acid test and the green loan

We previously discussed the concept of “ESG acid test”. Once the COVID-19 pandemic has passed, the practice of investing in companies that comply with ESG standards will surely continue to grow. The coronavirus pandemic presents an opportunity for investors with ESG mandates to delve into a company’s track record before making capital allocation decisions. This means that the actions of companies during the COVID-19 crisis can act as an acid test.

Likewise, efforts to rebuild the global economy in the wake of the COVID-19 pandemic will surely lead many borrowers and lenders to focus on rebuilding the economy in a sustainable manner, leading to a “ new green deal. or a “ green recovery ”. We urge all market participants not to fall behind.

-

Community Wide Federal Credit Union Review – Forbes Advisor

[ad_1] Editorial Note: We earn a commission on partner links on Forbes Advisor. Commissions do not affect the opinions or ratings of our editors. ... -

AI explainability specialist Truera closes $ 12 million funding round

[ad_1] Truera Inc., a startup that works to give companies a better insight into how their artificial intelligence models make decisions, today mentionned that ... -

PPP loan recipients could see tax hikes

[ad_1] (WAOW) – A major shock to businesses in Wisconsin and the country, as recipients of the federal paycheck protection program could be forced ... -

Luke Freeman opens up about Nottingham Forest loan and Sheffield United future

[ad_1] Luke Freeman says he’s not sure what the future holds after a stop-start season at Nottingham Forest. The blades The midfielder is on ... -

Scott Twine interview: Newport midfielder on loan, regular playing time and enjoying football ‘more than ever’ | Football news

[ad_1] For Scott Twine, on loan from Newport, loan periods were as much about gaining experience in life as it was about developing in ... -

Is it possible to build up credit when you don’t have a job?

[ad_1] Dear Penny, I am a housewife who does not work outside of my home. The only income I have on my own is ... -

PPP loans: millions of business owners need help

[ad_1] The Small Business Administration and the Treasury Department are relaunching the Paycheck Protection Program five months after the end of its first two ... -

Does it make sense to group flights and overland travel together when purchasing travel insurance? – Councilor Forbes

[ad_1] Editorial Note: Forbes Advisor may earn a commission on sales made from partner links on this page, but this does not affect the ... -

Trump signs 5-week PPP extension

[ad_1] President Donald Trump on Saturday signed a bill reopening the Paycheck Protection Program (PPP) application window until August 8. The five-week extension was ... -

Dick Vitale slams Sean Miller in light of recent NCAA allegations

[ad_1] Controversy surrounds Arizona basketball head coach Sean miller. According to a report through Bruce Pascoe in the Arizona Daily Star, school president Robert ... -

Umphrey’s McGee navigates pandemic with live broadcasts, two drive-through concerts

[ad_1] Andrew S. Hughes Umphrey’s McGee guitarist Brendan Bayliss never thought that the sound of 500 car horns honking at the same time could ... -

MRC grants $ 173 million construction loan for MAG Partners’ West Chelsea rental project – Commercial Observer

[ad_1] Madison Real Estate Capital (MRC) has just concluded a $ 173 million construction loan for the development of 241 28th Street West, learned ... -

Pros and Cons of Debt Management Plans

[ad_1] If you are burdened with your debts, you are not alone. The average American has over $ 90,000 in debt, including credit cards, ... -

Can my grandparents pay off part of our mortgage – or could we fall into a tax trap?

[ad_1] My grandparents kindly offered to pay off a six-figure amount on our mortgage. We have to remortgage in the coming months and while ... -

PPP Law Changes Under $ 1.9 Trillion Stimulus Package

[ad_1] CHANGES TO THE PPP LAW Getty As part of the proposed $ 1.9 trillion stimulus package, the paycheck protection program would be expanded ... -

Spring Finance returns to the second mortgage market

[ad_1] “We believe the time is right to relaunch Spring’s second mortgage product offering, albeit with a cautious approach, to our valued broker partners.” ... -

Paycheck Protection Loans Helped Archdiocese and Many Parishes in Early Stages of Pandemic

[ad_1] iStock The Archdiocese of St. Paul and Minneapolis is among dioceses across the country whose central offices have received loans from a federal ... -

California lawmakers approve COVID-19 plan, including checks for $ 600

[ad_1] Californians who qualify for a $ 600 state stimulus payment could see the money arrive as early as a month after filing their ... -

How this YouTube creator paid off his debt

[ad_1] Select’s editorial team works independently to review financial products and write articles that our readers will find useful. We may receive a commission ... -

Catholic bishops defend participation in federal payday loan

[ad_1] This Catholic News Service report said Catholic lobbyists worked, during the week the law creating the program was passed, to ensure that the ... -

Developer Launches Over the Moon Estates in Maryville

[ad_1] MARYVILLE – Marc and Pamela Hurt-Bacchetti are launching Over the Moon Estates, a development of 91 homes. Village trustees on Wednesday approved a ... -

Things To Remember When Getting Instant Cash Loans For Home Improvement

How do I get a loan for home improvements?

A home improvement loan can be described as an unsecure personal loan that you take out to cover the cost of repairs or upgrades. The lenders offer these loans that can be up to $100,000. The home renovation loan is offered in a lump sum and then you pay it back in monthly installments for a period of between one and 12 years.

Since you do not use your home as collateral in this type of loan and the interest rate is determined by details such as the amount of your credit and earnings. If you are unable to repay the loan for home improvements and you don’t repay it, your credit will suffer.

Home improvement loans in contrast to equity financing

An improvement mortgage can make sense when you don’t have enough equity in the property or do not wish to make use of this as collateral. The equity is the amount that’s between your home’s worth and the amount you owe to your mortgage.

If you have equity you may be able to get lower monthly payments from an equity loan for your home or line credit, However, the lender might require an appraisal prior to approval.

Home equity loan

Equity loans for homeowners can be purchased in lump sums and come with fixed rates of interest, which means that your monthly payments will not change. The loan is repaid in monthly installments over an amount that can be between 15 and 30 years.

Compared to personal loans The home equity loan works similar to personal loans, however, they usually have lower rates and longer repayment times.

The Home Equity line of credit

A HELOC is an open credit line that you can draw upon as you need for renovations and you will only be charged interest for the amount you are able to borrow. It’s a variable-rate loan which is ideal if you do not mind having a fluctuating monthly installment and want to have more borrowing flexibility.

Compare with personal loans The difference is that a HELOC allows you to borrow anytime for around 10 years. It is perfect for projects that require a long time or for unexpected costs. Personal loans are a great option for unexpected expenses. A personal loan offers a one-time cash flow.

How do you obtain a home improvement loan?

For a home improvement loan, first, check the lender’s offers against other options, then check your rates and monthly payments then prepare the documents and apply.

Let’s break them down:

- Compare the various options. Find the top home improvement lenders against one another and against other financing options like credit cards or mortgages based on equity. You’re trying to find the one that is priced at the lowest in the total cost of interest, is affordable for monthly installments, and can be incorporated into your timetable.

- Review your monthly rate and payments. Make sure you set your project’s cost estimate with this method. A lot of online lenders and banks allow borrowers to look at the possibility of personal loan offers before applying however you’ll be asked to specify the amount you’d like to take out. The process is a gentle credit draw.

- Prepare documents. If you’ve decided to apply for a loan collect the documents you’ll need to present to the lender. This could include things like W-2s, payslips as well as proof of address and financial details.

- Apply. You might have applied in person. You may have to make an application on the spot at small banks or credit unions, however larger ones and lenders online typically provide online applications. Most lenders will make an answer within a couple of days after submitting. Then, you can expect to have the money in your account within less than one week.

-

Nasdaq’s $ 240 million stock market investment targets Saudi investors

[ad_1] LONDON: Climate activists who scored big against Western majors last week had unlikely cheerleaders in the oil capitals of Saudi Arabia, Abu Dhabi ... -

Kinepolis limits cash consumption in 2020 and maintains a solid

[ad_1] Kinepolis limits cash consumption in 2020 and maintains a solid financial base throughout the Covid-19 crisis Regulatory release February 25, 2021, 7 a.m. ... -

Coronavirus Relief Bill with Aid to Rural Hospitals Passed by Senate

[ad_1] The Senate this weekend passed a massive coronavirus relief bill that is now coming back to the United States House of Representatives for ... -

State-funded program can reduce upfront costs for local buyers

[ad_1] HOLLAND – An expanded homeownership program now available in Michigan to help homebuyers with their down payment is available in the Netherlands. The ... -

New Jersey’s Wonderland Amusement Pier, Owned by the Mayor of Ocean City, in Danger from Sheriff’s Auction – NBC10 Philadelphia

[ad_1] A nearly century-old amusement boardwalk along the beach in Ocean City, New Jersey, was put up for auction on Jan.21 because the owner, ... -

Hope the student loan cancellation won’t pay the bills

[ad_1] (Nerdwallet) – Federal student loan borrowers are anxiously waiting to see if the loan cancellation – which President-elect Joe Biden says will make ... -

Lower rates, an opportunity to renegotiate the interest on your mortgage

[ad_1] The Covid-19 crisis has hurt borrowers in many ways. The only respite some may have is the reduction in the interest rate on ... -

Dublin cheese maker Carbery obtains a 35 million euro loan from the EIB

[ad_1] Carbery, headquartered in Liège, has secured a € 35 million loan from the European Investment Bank (EIB) to cover the cost of a ... -

How the VA Retirement Plan Benefits Your Bottom Line

[ad_1] If you are in the workforce, you are probably planning to retire someday. No matter how old you are, it’s never too early ... -

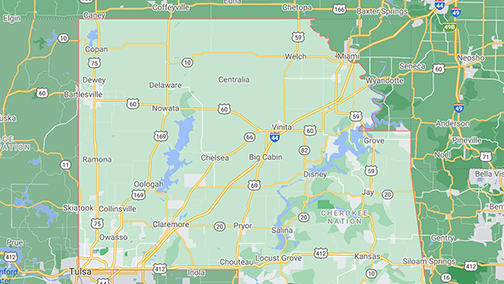

Cherokee Nation reserve boundaries including Owasso, Collinsville, now visible on Google Maps | New

[ad_1] The borders include 7,000 miles in northeast Oklahoma, which includes the cities of Owasso and Collinsville. Owasso Reporter Editor Art Haddaway The Cherokee ... -

New sculpture by Montgomery artist to be loaned to church

[ad_1] Andrew Logan with the Cross of St David Andrew Logan has completed his sculptural cross just in time for St David’s Day and ... -

End of moratorium on student loans and resumption of full payments

[ad_1] Experts say there is a chance President-elect Joe Biden will extend moratorium or enact some form of student loan cancellation CHARLOTTE, North Carolina ... -

Elizabeth Warren, Democratic presidential candidate, responds after angry father confronted her with student loans

[ad_1] After being confronted by a man questioning her student loan forgiveness plan, Democratic presidential candidate Elizabeth Warren rejected her argument. “We are not ... -

Mikel Arteta offers William Saliba a lifeline at Arsenal amid Nice loan spell

[ad_1] Saliba is frustrated with his lack of chances at Arsenal since his £ 27million transfer ended in 2019 after Arteta told him he ... -

Baltimore Ravens become latest team to postpone activity as athlete strikes escalate to protest police fire

[ad_1] TOP LINE The US sports games were canceled this week as professional athletes rallied to strike in protest after the police shooting Jacob ... -

Amid delays, small businesses desperately wait for PPP loans

[ad_1] Last year, Barbara Thigpen had a difficult choice to make: close her 10-year-old salon, or tap into her son’s college fund. The salon ... -

Metro Detroit businesses hope they won’t lose loan program again

[ad_1] As for simple take-out food service, McShane’s Irish Pub laid off most of its 67 employees at three locations in Southeast Michigan after ... -

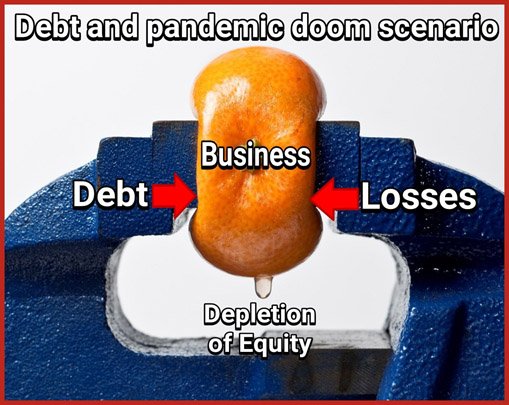

Catastrophic scenario unfolding as window dressing seems to be the government’s priority!

[ad_1] To share1 By Savvakis C. Savvides A business today is like an orange that is forcibly squeezed from both sides under conditions of ... -

Asia-Pacific actions are mixed; Fall in Hong Kong listed equities to the minimum wage

[ad_1] SINGAPORE – Stocks in Asia-Pacific were mixed on Monday as the coronavirus situation in parts of North Asia remained dire. Mainland Chinese stocks ... -

Biden’s choice to lead economic advisers viewed as sympathetic to loan borrowers

[ad_1] While President-elect Biden’s choice to chair her Council of Economic Advisers, Cecilia Rouse, did not call for the cancellation of student debt, she ... -

Understanding the neurosciences behind emotional intelligence

[ad_1] When you are placed in different situations in your relationships with other people, do you ever feel like you can understand their emotions? ... -

Aqua Metals (AQMS) Q4 2020 Earnings Call Transcript

[ad_1] Image source: The Motley Fool. Aqua Metals (NASDAQ:AQMS)Q4 2020 Earnings CallFeb 25, 2021, 4:30 p.m. ET Contents: Prepared Remarks Questions and Answers Call Participants Prepared ... -

Kennedy Wilson Debt Platform Reaches $ 1 Billion in Western US

[ad_1] Kennedy Wilson’s Debt Investment Platform has reached $ 1 billion in secured loans in the western United States. The team has secured a ... -

APAC’s first semester loans drop to lowest level in eight years

[ad_1] HONG KONG, June 30 (LPC) – Syndicated loans in Asia-Pacific, excluding Japan, plunged to their lowest level in eight years as the global ... -

Small Business Loans With Paycheck Protection Lean Strongly Into Existing Customers |

[ad_1] “We are actively processing requests as we receive them,” the bank said. “… When someone registers on our PPP page on www.Truist.com, they ... -

Oma Savings Bank Plc Annual and Financial Report

[ad_1] OMA SAVING BANK PLC, BROADCAST ON MARCH 9, 2021 AT 10AM EET, ANNUAL FINANCIAL REPORT Publication of the 2020 annual report and financial ... -

Muthoot Finance Price: Muthoot Finance Shares Fall After President Passes By | India Business News

[ad_1] BENGALURU: Shares of Indian non-bank financial company Muthoot Finance Ltd fell the most in nearly two months on Monday, following the death of ... -

UK banks brace for $ 22 billion loan losses as outlook darkens

[ad_1] Through Iain Withers, Laurent Blanc LONDON (Reuters) – British banks took a darker view than almost all of their European counterparts in their ... -

New Orleans Charters Get Millions in Small Business Loans, Deepening Coronavirus Aid Debate | Coronavirus

[ad_1] More than two-thirds of New Orleans charter school organizations have applied for federal loans through congressional law to help keep businesses afloat during ... -

5 reasons your credit score might suddenly drop

[ad_1] Select’s editorial team works independently to review financial products and write articles that our readers will find useful. We may receive a commission ... -

Inside Texas Politics: TWC Could Replenish Unemployment Money With Federal Loan Or COVID-19 Funds

[ad_1] Comptroller Glenn Hegar said Texas could replenish the fund by securing a federal loan or using some of the COVID-19 money coming into ... -

In India, gold-based finance is booming

[ad_1] Aug 13, 2020 VSWASTING TIME for Muthoot Finance’s Kondapur branch in Hyderabad, it is usually 5:30 p.m. on a Monday. But on August ... -

OVERVIEW: Taxing Payroll Protection Program Loans and Canceling Loans

[ad_1] The rules governing the Paycheck Protection Program (PPP) have evolved since the passage of the CARES Act on March 27, 2020, and lenders ... -

Wake Forest Bancshares, Inc.Announces Year-End Results

[ad_1] WAKE FOREST, NC, December 16, 2020 (GLOBE NEWSWIRE) – Wake Forest Bancshares, Inc., (OTC BB: WAKE) parent company of Wake Forest Federal Savings ... -

Chase Unveils New Freedom Flex Card, Updates Freedom Unlimited

[ad_1] Chase announced a new addition to its line of credit cards, the Chase Freedom Flex® by Mastercard, along with updates to the Chase ... -

Sun Communities, Inc. announces pricing for its public offering

[ad_1] Southfield, Michigan, March 04, 2021 (GLOBE NEWSWIRE) – Sun Communities, Inc. (NYSE: SUI) (the “Company”), a real estate investment trust (“REIT”) that owns ... -

US Congress releases $ 25 million for democracy and gender programs in Pakistan

[ad_1] The US Congress on Tuesday approved $ 25 million in civilian aid to Pakistan to strengthen democracy and promote women’s rights in the ... -

SBA makes loans available to farmers in the event of economic disasters

[ad_1] Farms affected by losses from COVID-19 are now eligible for the Small Business Administration’s EIDL Economic Disaster and Advance Loan programs. According to ... -

NTPC to borrow $ 478 million from Japanese banks to finance clean energy

[ad_1] CHENNAI (Reuters) – India’s largest power producer, NTPC Ltd, on Wednesday said it would borrow 50 billion yen ($ 478 million) from Japanese ... -

Mortgages Crash 2020 Records at $ 4.3 Trillion

[ad_1] Mortgage creations for 2020 hit a record high of $ 4.3 trillion, according to the latest report from Black Knight’s Mortgage Monitor released ... -

5 tips for buying a house in the real estate market from a seller

[ad_1] There is no doubt that we are in a sellers real estate market. With stocks at their lowest, demand rising sharply and prices ... -

Florida Bill Seeks to Expand PACE Loan Program

[ad_1] A Florida lawmaker is looking to expand a loan program that allows people to make their homes more energy efficient, but leaves many ... -

Mat Ishbia presents UWM’s purchasing strategy

[ad_1] From HousingWire Spring summit Thursday, UWM CEO Mat Ishbia sat down with HousingWire CEO Clayton Collins to discuss UWM’s strategy for this buying ... -

BBB gives more details about the payback loan program

[ad_1] The British Business Bank gave more details on the new Treasury recovery loan program. The system of government, Unveiled by Chancellor Rishi Sunak ... -

Buchalter’s COVID-19 Customer Alert: Treasury’s New PPP Rules Clarify Recent Changes to PPP Program, Extend Time to Obtain PPP Loan Until March 31, 2021 | Buchalter

[ad_1] January 8, 2021 Through: Michael C. Flynn On January 6, 2021, the Treasury released two new Provisional Final Rules (IFR) on the new ... -

Definition of the loan note

[ad_1] What is a loan note? A loan note is an extended form of a generic I owe you (IOU) document from one party ... -

Why are interest rates so low and how long will they stay low?

[ad_1] A: The Federal Reserve is lowering interest rates in order to stimulate growth during a time of economic decline and uncertainty, which means ... -

Morgan Stanley will be the first U.S. bank to disclose how its loans and investments contribute to greenhouse gas emissions

[ad_1] Morgan Stanley will begin measuring and disclosing the loan portfolio’s greenhouse gas emissions and will support the push towards universal climate risk accounting ... -

Hays PPP loans for businesses in millions of dollars

[ad_1] By Sahar Chmais Hays County businesses have received millions of dollars in Paycheck Protection Program (PPP) funds, although many businesses either did not ... -

Aqua Pennsylvania receives PENNVEST loan to add PFAS treatment to Montgomery County well

[ad_1] BRYN MAWR, PA – (BUSINESS WIRE) – Aqua Pennsylvania today announced that it has received approval for a PENNVEST loan that will be ... -

PREIT Secures $ 4.5 Million Paycheck Protection Loan for Small Business and Real Estate Tax Delays as Losses Rise

[ad_1] PREIT, owner of the old Gallery Mall, Cherry Hill Mall and 19 other shopping centers, received a $ 4.5 million forgivable loan from ... -

The atomic bomb saved millions, including the Japanese

[ad_1] The atomic bombings of Hiroshima and Nagasaki, 75 years ago on Thursday and Sunday respectively, are viewed with horror and regret. But do ... -

Mississippi lawmakers assess teacher increases and alcohol delivery

[ad_1] JACKSON, Mississippi – Lawmakers in Mississippi are making decisions that could affect people’s wallets and alter some of their leisure time activities. Teachers ... -

“I had nothing left”: loan sharks target Indian sex workers affected by pandemic

[ad_1] When Indian sex worker Baji fell behind on her loan repayments during the lockdown, her home was ransacked and her only possessions of ... -

Small alcohol distillers rally to meet demand for hand sanitizer

[ad_1] With hand sanitizers running out of stock in stores and distribution centers, he leaves a lot of it without during the coronavirus epidemic. ... -

Martin Lewis asks Rishi Sunak about 4th SEISS grant as millions say “wait until April”

[ad_1] In the aftermath of Wednesday’s speech, Lewis said he heard floods of people facing homelessness after being ordered to wait until April to ... -

Comvest Credit Partners announces investment in Beyond

[ad_1] WEST PALM BEACH, Fla., February 8, 2021 (GLOBE NEWSWIRE) – Comvest Credit Partners (“Comvest”) acted as administrative agent and sole lender in providing ... -

Loan engineering goes digital – theMReport.com

[ad_1] Tom showalter Seven seconds is not a long period of time, at all. There isn’t a lot of activity you can do in ... -

Trump’s Chances of Winning Pennsylvania Fade

[ad_1] Top line A high-quality poll on Tuesday found Joe Biden to be well ahead in the battlefield state of Pennsylvania, a state crucial ... -

HSBC launches new service with Biz2Credit to streamline

[ad_1] HSBC Bank‘s launch of the Biz2X platform gives customers faster access to loans and credit cards NEW YORK, November 12, 2020 (GLOBE NEWSWIRE) ... -

Americans affected by COVID-19 should be able to pay off student loans in bankruptcy, says Scanlon, congressman from Philly

[ad_1] In a bill that could expand bankruptcy laws, U.S. Representative Mary Gay Scanlon (D., Pa.) Is expected to introduce federal legislation Thursday that ... -

Ready to help modernize Manchester city center building | Manchester

[ad_1] MANCHESTER – The Economic Development Commission has approved its second zero-interest loan, this one to a group hoping to revitalize a major downtown ... -

Ask Chuck: What Does the Bible Say About Payday Loans? | Opinion News

[ad_1] Through Chuck bentley, CP guest contributor | Friday August 26, 2016 To know the biblical answers to your financial questions, you can #AskChuck ... -

12/17/2020 | Reflections from the Editor’s Office – December 18, 2020

[ad_1] Planning Commission Approves Ok North OC Restaurant Redevelopment Project OCEAN CITY – A popular northern crab house and restaurant will soon be given ... -

Kushner companies seek $ 1.15 billion federal loan

[ad_1] Kushner Companies, the real estate company owned by the family of senior White House adviser (and presidential son-in-law) Jared Kushner, has reportedly requested ... -

Suspension of payment of student loans extended until January 31

[ad_1] Borrowers will get an additional month’s stay on their student loans. photo by robyn beck / Agence France-Presse / Getty Images Student loan ... -

Animal Ark Wildlife Sanctuary’s New Cheetahs Must Be Named

[ad_1] Animal Ark has three fluffy, spotty residents and they’re just the dose of cuteness the world needs right now. The 4-month-old cheetah babies ... -

Tips for exchanging vehicles: from staging to negotiation

[ad_1] Trading in a vehicle while you’re looking for your next car can be hard to juggle, but we’ve got a few tips to ... -

Signature Bank Ranked # 2 in the United States in Three National Law Journal “Best of” Categories for Third Consecutive Year

[ad_1] NEW YORK–(COMMERCIAL THREAD) –Signature Bank (Nasdaq: SBNY), a New York-based full-service commercial bank, announced today that it is second in the United States ... -

Former Company Director Charged With Alleged $ 16 Million Loan Scam, Courts & Crime News & Top Stories

[ad_1] A man who allegedly tricked people into loaning him millions of dollars by promising high returns faces a total of 344 charges in ... -

Traverse City Light and Power offers funding for energy upgrades

[ad_1] A utility in northern Michigan wants to help its customers improve their energy efficiency by offering low-interest loans for home renovations. Traverse City ... -

President Alvarado, Eduardo Cruickshank again calls on Costa Ricans to dialogue:

[ad_1] President Carlos Alvarado and Eduardo Cruickshank, Speaker of the Legislative Assembly, presented a multisectoral roundtable on Sunday aimed at addressing Costa Rica’s economic ... -

Advice from “Cake Boss” star Buddy Valastro to business owners during the coronavirus pandemic: “You have to pivot”

[ad_1] As the Coronavirus pandemic continues to increase across the country, “Cake Boss” star Buddy Valastro share some tips with entrepreneurs who are struggling ... -

Vaccine groups secured more than $ 1 million in PPP loans

[ad_1] Federal Paycheck Protection Program loans have been made to organizations questioning vaccine safety and spreading misinformation about the coronavirus pandemic, data obtained after ... -

F-15E Strike Eagle Tests ‘Bomb Truck’ Configuration Capable of Carrying 15 JDAM

[ad_1] The 85th Test and Evaluation Squadron successfully flew an F-15E Strike Eagle carrying six JDAMs on one side of the aircraft on February ... -

Mnuchin ‘reconciles’ by stripping Fed of emergency loan funds: former TARP inspector

[ad_1] A former government official responsible for overseeing the 2008 bailout funds said Treasury Secretary Steven Mnuchin was defying the law by locking in ... -

Reimbursable PPP expenses are not deductible

[ad_1] Wednesday, December 16, 2020 Payroll Protection Program (P3) loans are eligible for a rebate depending on whether or not the loan proceeds are ... -

Are you ready for your PPP loan audit? | Burr & Forman

[ad_1] PPP loans received by individuals and businesses under the CARES Act will be audited (“reviewed”) by the SBA. The new Economic Aid Act ... -

Trump skews the truth about aid loans and virus risk

[ad_1] WASHINGTON (AP) – President Donald Trump has painted a rosy picture of a smooth-running federal emergency lending program for small businesses that does ... -

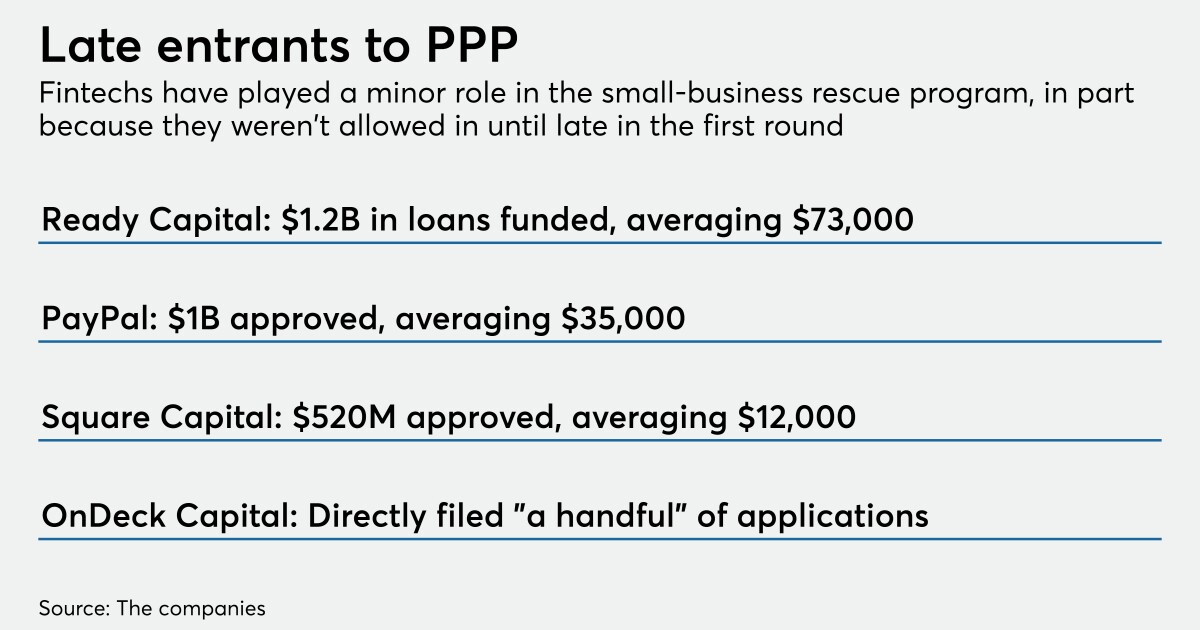

Fintechs hope PPP performance will lead to expanded role with SBA

[ad_1] Many fintechs have struggled to gain traction in the paycheck protection program. Most were excluded from the first round of the $ 669 ... -

No, you don’t need #SaveTheStrand | Arts

[ad_1] For decades, book lovers and tourists alike have flocked to the Strand Bookstore in New York’s Greenwich Village to marvel at the 23 ... -

Senators try to push forward bill extending terms of corporate loans against coronaviruses

[ad_1] FILE PHOTO: US Senator Susan Collins (R-ME) wears a mask as she participates in the Senate Committee on Health, Education, Labor and Pensions ... -

Funding of Legal-Bay prosecutions focused on wrongful convictions and imprisonment cases

[ad_1] TRENTON, New Jersey, February 25, 2021 / PRNewswire / – Legal-Bay LLC, the lawsuit settlement finance company, has announced its commitment to providing ... -

Nightingale and Wafra buy $ 860 million loan to create post-COVID super-office

[ad_1] Frequent Partners, Nightingale Properties and Wafra Capital Partners (WCP) is seeking a redevelopment loan to finance the renovation and modernization of 111 Wall ... -

February 11 mortgage rates

[ad_1] Freddie Mac, the federally chartered mortgage investor, aggregates the rates of about 80 lenders across the country to establish weekly average national mortgage ... -

East Grand Forks on-call firefighters pay raises OK, and hear about EDA’s business loan program

[ad_1] On Tuesday, January 19, council members voted 6 to 1 to increase the wages of these firefighters from $ 12 to $ 14 ...

/GettyImages-878960792-5c71a473c9e77c000151ba72.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/K4OL236MZJE6PP2OT7EGFNPVY4.jpg)

/https://specials-images.forbesimg.com/imageserve/5f490c660da323df31179ca6/0x0.jpg?cropX1=0&cropX2=5472&cropY1=0&cropY2=3077)

/https://blogs-images.forbes.com/forbescoachescouncil/files/2020/04/a-6-9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/FRV2W3R5BFJSVJVPL7HJTLQMGA.jpg)

/GettyImages-589574792-da826408a29a4c3b918485771fa0c708.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/pmn/C4GL6SYKJZBNVNKQSIS554ZWM4.jpg)

/https://specials-images.forbesimg.com/imageserve/5f7ca861138236cfcd2e1c9e/0x0.jpg?cropX1=0&cropX2=4772&cropY1=0&cropY2=2684)

/cloudfront-us-east-1.images.arcpublishing.com/pmn/CVL2W4H7TNDEHP2IYB3RLXKGSM.jpg)