3 reasons to invest in renewable energy stocks

[ad_1]

Renewable energy stocks have been on fire for the past year, with investors starting to recognize the industry’s growth and maturation in recent years. It didn’t hurt that President Biden’s election will likely lead to political gains for wind, solar, and energy storage over the next four years.

If you are still on the barrier of renewables compared to other energy stocks, there are three reasons why renewables are the future.

Image source: Getty Images.

Growth requires renewable energies

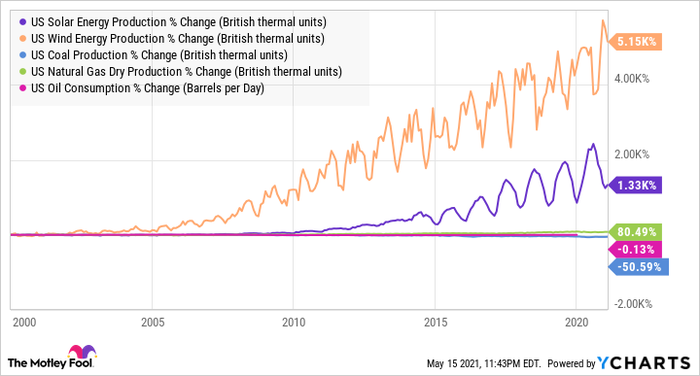

Oil, natural gas, coal and nuclear power may still be more important energy sources, in terms of absolute consumption, than any other renewable energy source, but they are not where they are. growth lies. You can see below that wind and solar have been by far the fastest growing energy sources in the United States since 2000, and the same trends continue around the world.

US Solar Power Generation Data by YCharts

Despite all this growth, wind power only accounts for about 8.4% of all electricity consumed in the United States and solar power accounts for 3% of the electricity supply, so there is a lot of potential. growth to come. And there’s a big reason wind, solar, and other renewable assets will continue to grow.

Renewable energies are cheaper than fossil fuels

Perhaps the main reason for believing in renewables is the trajectory in which costs are heading. As it becomes more expensive to build nuclear power plants, oil becomes harder to find and coal becomes less competitive every day, the costs of renewables are dropping.

Below is the unsubsidized cost of wind, large-scale solar, natural gas, nuclear and coal power plants according to Lazard. Leveled Energy Cost Analysis, which he publishes every year. You can see that between 2010 and 2020 the costs of wind and solar power fell and the only fossil fuel that has fallen in cost is natural gas.

| Energy source | 2010 Cost per MWh | 2020 Cost per MWh | Midpoint change |

|---|---|---|---|

| Wind | $ 99 to $ 148 | $ 26 to $ 54 | (68%) |

| Solar (utility) | $ 226 – $ 357 | $ 29 to $ 42 | (88%) |

| Combined cycle gas | $ 67 to $ 96 | $ 44 to $ 73 | (28%) |

| Nuclear | $ 77-114 | $ 129 to $ 198 | 71% |

| Coal | $ 69 to $ 152 | $ 65 to $ 159 | 1% |

Data source: Lazard Level Energy Cost Analysis versions 4.0 and 14.0.

What’s more impressive is that the cost of wind and solar power now exceeds fossil fuels in most places. It’s no longer an industry that’s driven by grants or environmentalists – it’s profitable and winning long-term competitive bids. The next step he needs to truly take control of the energy industry is to make energy storage a viable business.

Innovation leads the way

What gives me the most confidence in renewables over the long term is the fact that innovation continues to drive the industry. Innovation cuts costs, creates better business models and spurs new technologies. Here are some innovations that excite me on the horizon.

- Solar storage plus: Battery storage is becoming increasingly viable for homeowners, commercial buildings and utilities. SunPower (NASDAQ: SPWR) and Sunrun (NASDAQ: RUN) are expanding their energy storage activities for homes by reducing utility bills as well as back-up power. And in the long run, they can play a role in making homes and EV charging smarter.

- Hydrogen fuel cells: The great opportunity for renewables is when long-term energy storage is viable. This would allow cheap solar power plants to make hydrogen by electrolysis to transport energy, which would fundamentally change the way we use electricity. Bloom Energy (NYSE: BE) is a leader in this field, building large fuel cells to turn hydrogen into electricity, but it is also launching an electrolyzer to turn cheap renewable electricity combined with water into hydrogen. As this technology becomes more cost effective, it could completely replace fossil fuels.

- Electric vehicles: Not only are electric vehicles helping to replace fossil fuel vehicles, they could eventually be a great place to store energy in the home. Imagine using your charged car to power your home during a power outage or storing your solar roof electricity for use at night.

- Smart homes: Another area of ​​innovation today is to make our sources of demand smarter. Homes can heat and cool at more efficient times, use less energy during peak hours, and draw power when wind and solar production is high. Companies like SunPower and Sunrun are developing tools to make homes smarter and use renewables more efficiently, and that will likely continue over the next decade.

As with any innovation or new product, we don’t know what’s going to win and different companies have different marketing strategies, so there is still a lot of risk for investors. But one way or another, I think innovation will drive the renewable energy industry forward.

How to invest in renewable energy stocks

If you dive into renewables, I mentioned three stocks that should do well as businesses grow. I like SunPower in residential and commercial solar and storage and Bloom Energy in hydrogen fuel cells.

If you are more risk averse and looking for dividends, Brookfield Renewable Partners (NYSE: BEP) and Hannon Armstrong sustainable infrastructure (NYSE: HASI) spend billions to build and purchase renewable energy and energy storage projects around the world. They will generate cash flow from these projects, which generate dividends that earn 3.2% and 3% respectively. No matter where you invest, renewables are clearly on the rise in the energy sector.

10 stocks we like better than SunPower

When investment geniuses David and Tom Gardner have stock advice, he can pay to listen. After all, the newsletter they’ve been distributing for over a decade, Motley Fool Fellowship Advisor, has tripled the market. *

David and Tom just revealed what they think are the top ten stocks investors can buy right now … and SunPower was not one of them! That’s right – they think these 10 stocks are even better buys.

See the 10 actions

* Stock Advisor returns as of May 11, 2021

Travis Hoium owns shares of Bloom Energy Corp and SunPower. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]